Soutěž v Silicon Valley o dominanci v oblasti umělé inteligence se odehrává na novém hřišti: superhvězdní výzkumníci.

Zatímco snaha přilákat špičkové talenty a udržet je spokojené byla vždy charakteristickým rysem technologického průmyslu, od spuštění ChatGPT na konci roku 2022 se nábor zaměstnanců vyostřil na úroveň profesionálních sportovců, jak pro agenturu Reuters uvedlo několik lidí zapojených do náboru výzkumníků v oblasti umělé inteligence.

„Laboratoře AI přistupují k náboru jako k šachové partii,“ řekl Ariel Herbert-Voss, generální ředitel startupu RunSybil zabývajícího se kybernetickou bezpečností a bývalý výzkumník OpenAI, který se po založení vlastní společnosti zapojil do boje o talenty. „Chtějí postupovat co nejrychleji, takže jsou ochotni zaplatit hodně za kandidáty se specializovanými a doplňujícími se znalostmi, podobně jako figurky v šachové partii. Ptá se: Mám dost věží? Dost jezdců?“

Společnosti jako OpenAI a Google (NASDAQ:GOOGL), které touží získat nebo udržet náskok v závodě o vytvoření nejlepších modelů AI, se snaží získat tyto takzvané „IC“ – jednotlivé přispěvatele, jejichž práce může společnosti udělat nebo zničit.

Noam Brown, jeden z výzkumníků stojících za nedávnými průlomy OpenAI v oblasti komplexního matematického a vědeckého uvažování, řekl, že když v roce 2023 zkoumal pracovní příležitosti, zjistil, že o něj usiluje technologická elita: oběd s zakladatelem Googlu Sergejem Brinem, poker u Sama Altmana a návštěva nadšeného investora v soukromém tryskáči. Elon Musk také bude telefonovat kandidátům na pozice ve své AI společnosti xAI, uvedly dvě osoby, které s ním mluvily. xAI na žádost o komentář nereagovala.

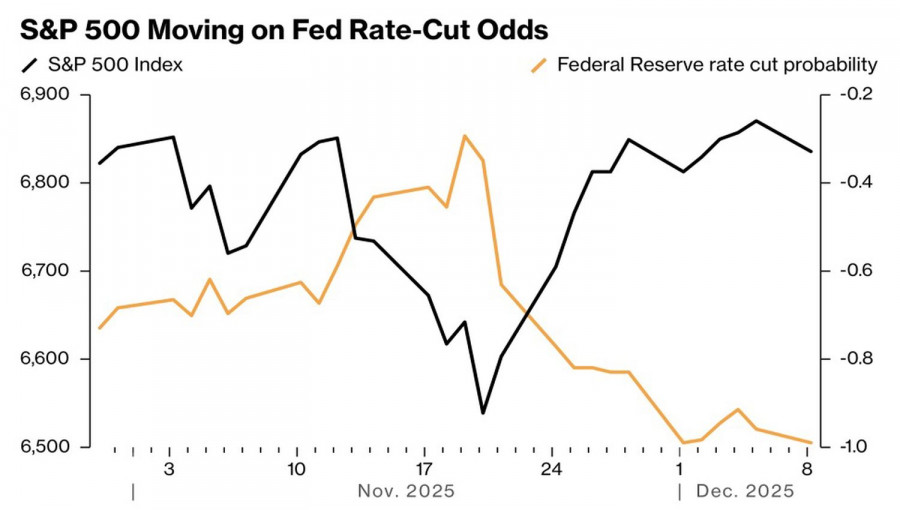

When markets are set for a hawkish cut, the chances of a dovish surprise increase. In reality, a reduction in the federal funds rate by 25 basis points to 3.75% is not the most important event on December 10. What will be more interesting for the markets is to observe the updated FOMC economic projections and listen to Jerome Powell's speech. Ahead of the meeting, investors preferred to take a step back. No one wants to take risks.

Despite the tepid response of the S&P 500 to several previous Committee meetings, this time could be different. Artificial intelligence, corporate profits, the resilience of the US economy, and expectations for monetary stimulus from the Federal Reserve are four key drivers of the American stock market in 2025. If even one of these factors plays out, the broad stock index may not be able to boast the impressive results in the coming year that it has achieved this year.

S&P 500's Reaction to Fed Meeting Outcomes

It is no surprise that institutional investors surveyed by Goldman Sachs are lowering their forecasts. Their estimates for the S&P 500 in 2026 fluctuate between 7,000 and 7,500. Just in October, when the broad stock index was nearing record highs, respondents believed in its rise to 7,200 by the end of 2025. According to HSBC Holdings, investors are underestimating the risks of a collapse in the US stock market.

A key part of the puzzle about the future of the S&P 500 is monetary policy. If the Fed accelerates the process of interest rate cuts, as desired by the White House, the broad stock index will thrive. However, there is a chance that the Federal Reserve will take into account the desire of central banks in other developed countries to make a hawkish turn. Australia, New Zealand, Europe, and likely Canada have signaled or are ready to signal the end of monetary expansion cycles. The Bank of Japan, in fact, intends to raise the overnight rate.

Dynamics of S&P 500 and Market Expectations for Fed Rates

The Fed is traditionally viewed as the leader of the pack of central banks, yet there is such desynchronization! Meanwhile, the S&P 500 is highly responsive to signals from the futures market regarding the scale of monetary policy easing. The decline in the broad stock index from record high levels was partly due to the October FOMC meeting minutes, where many Committee officials expressed disagreement with lowering the federal funds rate.

Another reason for the autumn pullback was fears regarding an AI bubble. Now, whenever investors hear the word "spending," they begin to sell. For instance, JP Morgan's shares were adversely affected after the company announced an increase in expenses in 2026 to $105 billion compared to a previous estimate of $101 billion.

Technically, on the daily chart of the S&P 500, the battle between bulls and bears continues for fair value at 6,840. A victory for sellers and a subsequent fall below 6,827 will trigger short-term selling. However, buying on rebounds from 6,805 and 6,770 remains a viable strategy.