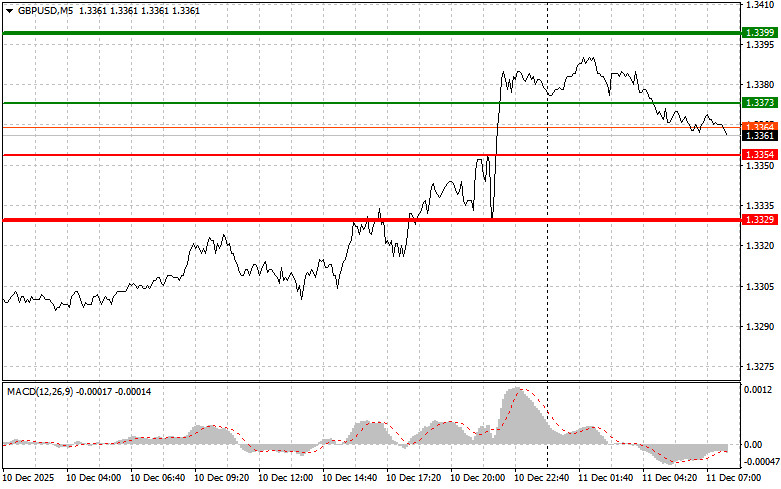

The test of the price at 1.3318 coincided with the moment when the MACD indicator was beginning to move upwards from the zero mark, confirming the correct entry point for buying the pound. As a result, the pair rose by more than 30 pips.

Yesterday, the Federal Reserve voted to lower the key interest rate by a quarter percentage point to 3.75%. This led to a weakening of the dollar and a strengthening of the British pound. The Fed's decision to cut rates was anticipated. In justifying their decision, Fed officials cited the slowdown in labor market growth. Immediately after this, the British pound showed strong growth, continuing its bullish run against the US dollar. The strengthening of the pound is associated with expectations that the Bank of England, unlike the Fed, may maintain a restrictive monetary stance in the near future.

Today, BoE Governor Andrew Bailey will speak in the first half of the day. His statements are expected to clarify the BoE's future monetary regulatory strategy. Given recent discussions of possible rate cuts by the BoE, traders and investors will pay particular attention to his analysis of the UK's economic situation, considering the latest data on inflation and the labor market. A detailed examination of his words will allow market participants to form a more complete picture of the prospects for the British economic system and possible scenarios for the development of monetary policy.

Regarding the intraday strategy, I will primarily rely on executing Scenarios 1 and 2.

Scenario 1: I plan to buy the pound today upon reaching an entry point around 1.3373 (green line on the chart), targeting growth to the level of 1.3399 (thicker green line on the chart). At around 1.3399, I intend to exit the market and sell immediately in the opposite direction, aiming for a movement of 30-35 pips from the entry level. Expectations of strong pound growth can only arise after good data. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning an upward move from it.

Scenario 2: I also plan to buy the pound today if the price tests 1.3354 twice in a row while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. A rise can be expected to the opposite levels of 1.3373 and 1.3399.

Scenario 1: I plan to sell the pound after the 1.3354 level (red line on the chart) is reached, which will trigger a quick decline in the pair. The key target for sellers will be the 1.3329 level, where I intend to exit the short positions and immediately buy back in the opposite direction, aiming for a move of 20-25 pips from this level. Sellers of the pound will show their strength in the case of weak data. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning its downward movement from it.

Scenario 2: I also plan to sell the pound today if two consecutive tests of 1.3373 occur while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected to the opposite levels of 1.3354 and 1.3329.

Important: Beginner traders in the Forex market need to make entry decisions with great caution. It is best to stay out of the market before significant fundamental reports to avoid sudden price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for the intraday trader.

RYCHLÉ ODKAZY